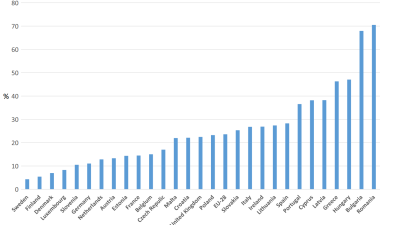

Reforms to the education and tax/benefit systems in the US could help to reduce income inequality and relative poverty, according to a working paper from the OECD in Paris. The paper highlights the fact that inequality and poverty in the US are among the highest for developed countries, and have also increased substantially in recent decades.

Key points

- Increasing income inequality in the US has been the result of a more unequal distribution of market income across households, and the tax-and-transfer system has not been sufficient to cushion this trend.

- The progressivity of the personal income tax system is reduced by various exclusions and allowable deductions, some of which lack a clear economic rationale and distort market forces. The effective tax rates of the 400 taxpayers with the highest levels of income declined from an average of 26.4 per cent in 1992 to 19.9 per cent in 2009.

- The US transfer system focuses on lowering poverty among specific groups of households: elderly people, disabled people, low-paid workers, lone parents and job-seekers. Other groups – including children – can fall through the cracks in the social safety net, reflecting the absence of a universal means-tested cash transfer programme.

- Comprehensive education reform (such as improving the quality of teachers and headteachers) could improve the access of disadvantaged students to high-quality education, which would help them raise their incomes and increase social mobility.

- Comprehensive reform of tax rules that disproportionately benefit high earners is also needed. This could include limiting the marginal income tax rate at which deductions and exclusions are permitted, as proposed by the current Obama administration.

- The transfer system lowers poverty among specific groups, but leaves others unreached. A stronger focus of eligibility criteria on income level is necessary. Simplifying the myriad of transfer programmes and their complex rules would lower administrative costs and increase take-up.

Source: Oliver Denk, Robert Hagemann, Patrick Lenain and Valentin Somma, Inequality and Poverty in the United States: Public Policies for Inclusive Growth, Economics Department Working Paper 1052, Organisation for Economic Co-operation and Development

Link: Paper

PSE:UK is a major collaboration between the University of Bristol, Heriot-Watt University, The Open University, Queen's University Belfast, University of Glasgow and the University of York working with the National Centre for Social Research and the Northern Ireland Statistics and Research Agency. ESRC Grant RES-060-25-0052.

PSE:UK is a major collaboration between the University of Bristol, Heriot-Watt University, The Open University, Queen's University Belfast, University of Glasgow and the University of York working with the National Centre for Social Research and the Northern Ireland Statistics and Research Agency. ESRC Grant RES-060-25-0052.