Most households now receive more in benefits than they pay in taxes, according to a think-tank report. The Centre for Policy Studies claims that, over the last 30 years, even middle-income households have moved from being significant net contributors to state funds to being significant net recipients.

Key points

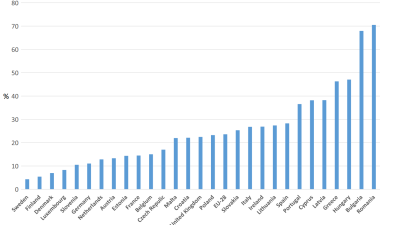

- In 2010-11, 53.4 per cent of households were overall net recipients of state money, compared with just 43.1 per cent in 1979 and 43.8 per cent as recently as 2000-01.

- In 1990, the middle quintile group of households faced an effective tax rate of 8.2 per cent. But by 2010-11 this had reversed: their effective tax rate was minus 20.4 per cent – that is, they received £4,589 more in benefits than they paid in taxation.

- Households in the top quintile group effectively finance the great majority of net transfers to all other households, paying £20,125 more in taxes each year than they get in benefits.

- At least part of this change in effective tax rates is down to changing demographics, with an increasing proportion of retired households in the middle three quintiles. But similar trends are also observed when purely examining non-retired households.

The report says these trends raise the issue of whether the 'safety net' provided by the welfare state has been extended too far up the income scale. It also questions whether this level of transfer is affordable in either the short or the medium term, particularly given the budget deficit.

One commentator – Full Fact – pointed out that the definition of 'benefits' used in the report includes not just social security spending but also the health, education and transport budgets. Much of the trend seen over the last decade may therefore be the result of higher investment in the NHS – rather than, as the report may be taken to suggest, a problem of growing 'welfare dependency'.

Source: Ryan Bourne, The Progressivity of UK Taxes and Transfers, Centre for Policy Studies

Links: Report | Daily Mail report | Full Fact commentary

PSE:UK is a major collaboration between the University of Bristol, Heriot-Watt University, The Open University, Queen's University Belfast, University of Glasgow and the University of York working with the National Centre for Social Research and the Northern Ireland Statistics and Research Agency. ESRC Grant RES-060-25-0052.

PSE:UK is a major collaboration between the University of Bristol, Heriot-Watt University, The Open University, Queen's University Belfast, University of Glasgow and the University of York working with the National Centre for Social Research and the Northern Ireland Statistics and Research Agency. ESRC Grant RES-060-25-0052.