The impact of the government’s 2010 Comprehensive Spending Review will fall disproportionately on women, finds two independent reports on the gender impact of the changes. The first report, by the Women’s Budget Group, analyses the overall impact of the tax, benefit and public spending changes in the government’s 2010 Comprehensive Spending Review (CSR) and finds that the cuts represent a reversal in progress made towards gender equality. The second report, a broad brush analysis by the House of Commons library, finds that nearly three-quarters of the cost of the main personal direct tax and benefit measures in the budget is being paid by women.

The Women’s Budget Group, a voluntary group of individuals from academia, non-governmental organisations and trade unions, argues that although the Treasury (2010a) undertook its own equalities impact assessment of the Comprehensive Spending Review, it offered almost no quantitative analysis of the differential impact on men and women and also excluded most elements of the spending cuts from its analysis.

Their assessment, The Impact on Women of the Coalition Spending Review 2010 published in November 2010, concludes that the package will ‘impact disproportionately on women’s incomes, jobs and the public services they use. Viewed as a whole, together with the measures announced in the June 2010 Emergency Budget, the cuts represent an immense reduction in the standard of living and financial independence of millions of women, and a reversal in progress made towards gender equality.’

The main reason for this is that women are heavier users of welfare benefits and public services than men. For example, 70 per cent of tax credits and 94 per cent of child benefit go to women. Between 2005 and 2008, 53 per cent of housing benefit claimants were women, 22 per cent were couples and 25 per cent were men (Welfare and Wellbeing Group, 2010). Women are also heavier users of social care and are more likely to live in households with children of school/pre-school age using education. They are more likely than men to be in households with no one in employment because of caring responsibilities or with no male earner.

There are some changes from which women will disproportionately benefit. One is the more generous up-rating formula for the basic state pension and pension credit as from 2011. This is being introduced sooner than Labour had proposed, the formula is more generous and it will benefit women by just over three to two compared with men.

There is also to be an increase in the child element of child tax credit by more than normal indexation in both 2011 and 2012. Nevertheless, the overall effect of the tax, benefit and public spending changes will be to make families worse off. Benefit will be withdrawn more quickly as earnings rise – for every £1,000 earned over £6,420 an extra £20 will be lost. The effect will be that, from April 2011, families will stop receiving tax credit when household income reaches £40,000 compared with the current £50,000. More families on low incomes will also face marginal deduction rates (the effective tax rate as a result of phasing out of benefits) of over 90, 70 and 60 per cent (though slightly reducing the numbers facing over 80 per cent) (HM Treasury, 2010b).

The cut in the proportion of childcare costs covered by Working Tax Credit, from 80 per cent of costs to 70 per cent of costs, will also adversely impact on women. It will mean a loss of up to £30 a week for help with childcare. Even when the increases to Child Tax Credit are factored in, this will mean a loss of around £20 a week for a family with two or more children. The Treasury’s own policy costing document for the CSR states that one of the impacts of this change will be to increase ‘the incentive for families to take on childcare themselves, or rely on extended family members’. This is not a work incentive. Many families will not be in a position to use family members; others will feel, even more than they already do, that it is not worth their while to work, for example, when a mother finishes maternity leave and checks out the cost of childcare.

Other changes that will adversely affect women include the three-year freeze in the value of Child Benefit, along with its withdrawal from women living in a household where one adult is a higher rate taxpayer; significant cuts to Housing Benefit, which the Department for Work and Pension’s own assessment has indicated will hit families the hardest; and a cap on the total amount of out of work benefit that a family will be entitled to, a change that will affect larger families the most.

Experts claim that many of these changes will reduce work incentives for those in low-paid jobs. For example, the change that requires couples to work for 24 hours between them, with one working at least 16 (currently, the requirement is that one partner works at least 16 hours) before they qualify for Working Tax Credit will mean that those who cannot increase their hours may find that they can no longer afford to work. The increase in the tax credit withdrawal rate will also impact on incentives. According to Ruth Lister, Professor of Social Policy at Loughborough University and a member of the Women’s Budget Group, ‘Given that one of the Tories’ priorities has been to improve work incentives, reiterated by George Osborne in his Budget speech, this aggravation of the poverty trap is perverse.’

The analysis by the Women’s Budget Group finds that as well as the benefit cuts falling disproportionately on women’s finances:

- Lone parents and single pensioners – most of whom are women – will suffer the greatest reduction in their living standards from public service cuts. Lone parents will lose services worth 18.5 per cent and female single pensioners will lose services worth 12 per cent of their incomes.

- Overall single women will lose services worth 60 per cent more than single men as proportions of their incomes, and nearly three times the amount lost by couples.

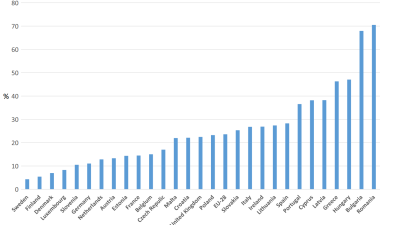

- Women are also likely to be the biggest losers from public sector job cuts. The main reason for this is the fact that women make up 65 per cent of the public sector workforce while 53 per cent of the jobs in the public sector services that have not been protected from the cuts are held by women. Just under 40 per cent of women’s jobs nationally are in the public sector, compared to around 15 per cent of men’s jobs. Women’s employment in the public sector is strikingly high in some regions.

The House of Commons library Budget Gender Audit, undertaken for Yvette Cooper MP, Labour’s spokeswoman on equalities, is a less sophisticated analysis than that of the Women Budget Group’s. The analysis looks at the main personal direct tax and benefit measures in the budget such as the increase in tax allowances and the capital gains tax rise, tax credit changes, benefit and pension changes. It doesn’t include indirect taxes such as VAT or Insurance Premium Tax, or business taxes such as corporation tax. In total the analysis covers over £8.1bn a year net revenue to be raised by 2014/15.

As the background note explains, ‘It is a broad estimate, based on a series of estimates and assumptions and calculations by the House of Commons library, using figures that are publicly available. It is not a detailed assessment based on individual tax and benefit data, and therefore remains a rough and ready approximation.’

Its key findings are that of the £8.1bn net personal tax increases/benefit cuts, an estimated £5.8bn (72 per cent) is being paid by women and £2.2bn (28 per cent) is being paid by men. In addition, support for children is being cut by £2.4bn – including cuts in Sure Start maternity grant, health in pregnancy grant, child benefit and tax credits. The majority of this support is paid to women.

References

HM Treasury (2010a) Overview of the Impact of Spending Review 2010 on Equalities, London, HM Treasury, available from http://cdn.hm-treasury.gov.uk/sr2010_equalities.pdf (accessed 17 January 2011).

HM Treasury (2010b) Budget 2010, London, The Stationery Office, endnote 4, table A3, p. 69.

House of Commons Library (2010) Budget Gender Audit, available from http://www.yvettecooper.com/uploads/d0e96a59-2a76-e5c4-ddfb-bd500dd16d5b.doc (accessed 17 January 2011).

Lister, R. (2010) ‘Did the Budget pass the fairness test from the perspective of women and families?’, blog entry posted 21 July 2010, available from http://www.touchstoneblog.org.uk/2010/07/did-the-budget-pass-the-fairness-test-from-the-perspective-of-women-and-families/ (accessed 17 January 2011).

Welfare and Wellbeing Group (2010) Retrospective equality impact assessment for Housing Benefit and Council Tax Benefit, available from http://www.dwp.gov.uk/docs/housing-benefit-and-council-tax-benefit.pdf (accessed 17 January 2011).

Women's Budget Group (2010) The Impact on Women of the Coalition Spending Review 2010, available from http://wbg.org.uk/RRB_Reports_4_1653541019.pdf (accessed 20 January 2011).

PSE:UK is a major collaboration between the University of Bristol, Heriot-Watt University, The Open University, Queen's University Belfast, University of Glasgow and the University of York working with the National Centre for Social Research and the Northern Ireland Statistics and Research Agency. ESRC Grant RES-060-25-0052.

PSE:UK is a major collaboration between the University of Bristol, Heriot-Watt University, The Open University, Queen's University Belfast, University of Glasgow and the University of York working with the National Centre for Social Research and the Northern Ireland Statistics and Research Agency. ESRC Grant RES-060-25-0052.