Relying on a 'snapshot' perspective tends to overstate inequalities in living standards between individuals, according to a new report from the Institute for Fiscal Studies. The authors call instead for inequalities to be examined from a life-cycle perspective.

Key points

- Most analysis of the impact of taxes and benefits on households is cross-sectional, with individuals classified as rich or poor using a single snapshot of data (often relating to a week or month).

- However, income and circumstances do not remain constant over time but vary across the life cycle. In particular, employment outcomes, household composition and health status all exhibit strong age profiles. This means that many more individuals experience circumstances of interest to policy-makers (such as unemployment or claiming out-of-work benefits) at some point in their life than at a given snapshot.

- In addition, individuals are, for the most part, able to transfer resources across periods of life through saving and borrowing.

- These factors mean that an exclusively snapshot perspective will tend to overstate disparities in living standards between individuals.

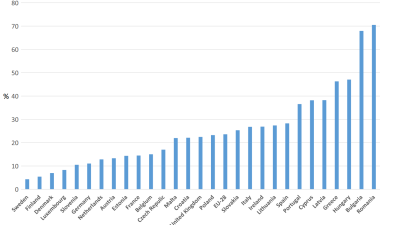

- Commonly used measures of inequality and redistribution evolve as the horizon under consideration is extended. For example, the Gini coefficients for gross and net income (which measure inequality) both fall by around a fifth when the full (18-wave) horizon of the British Household Panel Survey (BHPS) is used, compared with a single snapshot.

- Extending the horizon also has a substantial effect on two common measures of the impact of taxes and benefits on inequality: it reduces the Kakwani index of tax progressivity by almost 30 per cent, and the Reynolds-Smolensky index of redistributive effect by 17 per cent.

- Reforms to in- and out-of-work benefit reforms under the previous Labour government between 1999 and 2002 turn out to have a more progressive distributional impact from a long-run perspective, with the bottom decile benefiting more – reflecting the fact that being a low-wage parent (particularly a lone parent) is a good indicator for long-run poverty. In contrast, changing the horizon has relatively little effect when considering recent personal allowance increases or a 1p cut in the basic rate of income tax.

Source: Barra Roantree and Jonathan Shaw, The Case for Taking a Life-Cycle Perspective: Inequality, Redistribution, and Tax and Benefit Reforms, Report R92, Institute for Fiscal Studies

Links: Report

PSE:UK is a major collaboration between the University of Bristol, Heriot-Watt University, The Open University, Queen's University Belfast, University of Glasgow and the University of York working with the National Centre for Social Research and the Northern Ireland Statistics and Research Agency. ESRC Grant RES-060-25-0052.

PSE:UK is a major collaboration between the University of Bristol, Heriot-Watt University, The Open University, Queen's University Belfast, University of Glasgow and the University of York working with the National Centre for Social Research and the Northern Ireland Statistics and Research Agency. ESRC Grant RES-060-25-0052.